Kroll Bond Rating Agency (KBRA) has released a comprehensive report analyzing the exposure of KBRA-rated Commercial Mortgage-Backed Securities (CMBS), Freddie Mac, Commercial Real Estate Collateralized Loan Obligations (CRE CLO), and Single-Family Rental (SFR) sectors to the aftermath of Hurricane Milton. The research delves into the potential impact on property performance, financial stability, and loan obligations across the affected regions.

Hurricane Milton’s Impact on Real Estate and Finance

Hurricane Milton, which recently struck the Southeastern U.S., caused widespread damage across several states, including Florida, Georgia, and South Carolina. The Category 4 storm left a trail of destruction, with severe flooding and wind damage impacting residential, commercial, and industrial properties. As a result, there are growing concerns over the long-term effects this natural disaster may have on the real estate and financial markets.

KBRA’s research examines how properties in these regions, particularly those linked to CMBS, Freddie Mac, and CRE CLO, could be affected in the short and long term. The agency analyzed properties directly in the storm’s path and those in neighboring areas that could experience indirect consequences such as economic slowdown, insurance claims, and rising repair costs.

CMBS and CRE CLO Market Exposure

Commercial real estate is at the forefront of KBRA’s analysis, as CMBS and CRE CLO portfolios contain a significant number of properties located in hurricane-prone regions. The report indicates that while some properties are fully insured and have hurricane contingency plans in place, others may face challenges in rebuilding and recovering due to inadequate insurance coverage or operational disruptions.

KBRA’s findings suggest that while some properties will recover quickly, others, particularly in heavily damaged areas, may see reduced cash flows, potentially leading to loan delinquencies or defaults. This will have a direct impact on the performance of CMBS and CRE CLOs, particularly those heavily concentrated in retail, hotel, and multifamily properties.

According to the report, KBRA-rated deals with high exposure to these types of properties may experience short-term performance dips as property owners navigate insurance claims and repairs. However, KBRA’s analysis also highlights the resilience of the market, noting that properties in the hurricane’s path make up only a fraction of the overall portfolios.

Freddie Mac and SFR Exposure

The report also provides insight into the exposure of Freddie Mac and SFR-backed securities. Freddie Mac, which plays a key role in financing multifamily properties, has several properties in the regions hit by Hurricane Milton. However, KBRA’s research suggests that most of these properties are well-insured and located in areas less severely affected by the storm, mitigating potential risks.

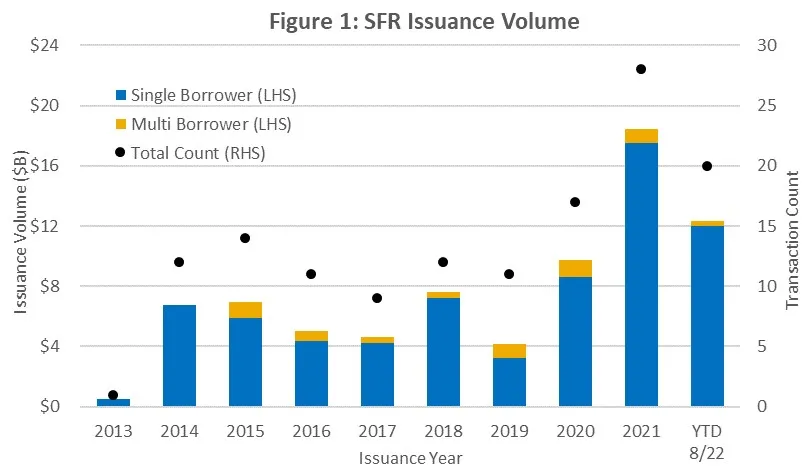

In the Single-Family Rental sector, SFR properties in hurricane-affected areas could face operational disruptions due to storm damage and delays in repairs. Nevertheless, KBRA notes that the SFR market is expected to remain resilient as demand for rental housing in unaffected areas remains strong, and some displaced homeowners may turn to rental housing as they recover.

Looking Ahead

While the full extent of Hurricane Milton’s financial impact remains to be seen, KBRA’s report emphasizes that the commercial real estate and mortgage-backed securities markets have built-in resilience measures, including insurance coverage, diversified portfolios, and government-backed assistance programs. Despite potential short-term challenges, the overall exposure of KBRA-rated CMBS, Freddie Mac, CRE CLO, and SFR portfolios to the hurricane is expected to be manageable.

However, KBRA advises investors and market participants to remain vigilant, as future weather events and natural disasters continue to pose risks to real estate markets, particularly in hurricane-prone regions. The agency will continue to monitor the situation closely and provide updated analysis as more data becomes available.

Conclusion

KBRA’s detailed research on the exposure of its rated CMBS, Freddie Mac, CRE CLO, and SFR securities to Hurricane Milton provides valuable insights into the potential risks and recovery strategies for real estate and financial markets. While some areas will face challenges in the near term, the resilience of the market and the presence of insurance and governmental support will help mitigate long-term damage. Investors are advised to keep a close watch on developments in the affected regions as the recovery process unfolds.